.... It's because Merchants can organize their finances all in one place with QuickBooks.... - See how using "integrated" payment processing greatly reduces your clients Indirect costs of payment processing.

Special alert: Same-Day ACH processing is available 9/23/2016.

Leigh will include SameDay ACH material in these three industry courses - FREE.

Other providers are charging in excess of $250!

1) Basic Credit Card Processing...

"What every CPA should know"

(The EMV "shift of liability" to merchants occurred on October 1st,

2015)

Field of Study: Economics: Money and Banking

Program Level: Basic

Pre-requisite: None | Delivery Method: Group Internet Based

Advanced Preparation: None | Type of Credit: CPE for CPAs

Who Should Attend: This live webinar is designed for all CPAs, small business owners, tax, accounting and other professionals.

Recommended CPE: 2 "Credit" hours

Cost: $29 - All 3 Credit Card Processing webinars, only $60

Presenter: Leigh Cook - CPA Merchant Services

Tuesday, August 9, 2016 ~ 1:00pm EST / 10:00am PST

Tuesday, August 16, 2016 ~ 1:00pm EST / 10:00am PST

FREE

Register for Basic Credit Card Processing on Aug 16, 2016 10:00 AM PDT

Tuesday, August 23, 2016 ~ 1:00pm EST / 10:00am PST

View Details and Registration Info

Course Description

Merchant payment processing education is necessary in today's evolving marketplace. Stay Competitive! Increase your billings with merchants. Save your merchants $1,000's annually after taking this course. Point of Sale Transactions, Ecommerce Sales, Mail-Order & Telephone Order, Accounts Receivable (A/R) and Accounts Payable (A/P) are the "life-blood" for most businesses. When a business has their Receivables under control they are free to thrive in their industry! Leigh will provide detailed instruction on Transaction & Interchange types, including the "Issuing Bank" and "Merchant Bank."

Leigh will take the time during and after the webinar to answer all your Payment Processing Questions.

Learning Objectives

- Demonstrate an understanding of industry "jargon"

- Introduce ways on how to save your clients money on their Credit Card Processing

- Explore the history of the credit card industry and definitions you need to be familiar

- Explain detailed instruction on Transaction & Interchange types, including the "Issuing Bank" and "Merchant Bank"

- Summarize all types of Customer Interaction with the merchant, including "Face-to-Face", eCommerce and MOTO (mail order / telephone order)

Professional course material will be transmitted prior to the webinar for your records.

Find out more about the Virtual Conference format

Register now for Basic Credit Card Processing... only $29

2) Intermediate Credit Card Processing...

"Payment Industry Insider Information"

Field of Study: Economics: Money and Banking

Program Level: Intermediate

Pre-requisite: Basic Credit Card Processing | Delivery Method: Group Internet Based

Advanced Preparation: None | Type of Credit: CPE for CPAs

Who Should Attend: This live webinar is designed for all CPAs, small business owners, tax, accounting and other professionals.

Recommended CPE: 1 "Credit" hour

Cost: $19 - All 3 Credit Card Processing webinars, only $60

Presenter: Leigh Cook - CPA Merchant Services

Wednesday, August 10, 2016 ~ 1:00pm EST / 10:00am PST

Wednesday, August 17, 2016 ~ 1:00pm EST / 10:00am PST

Wednesday, August 24, 2016 ~ 1:00pm EST / 10:00am PST

View Details and Registration Info

Course Description

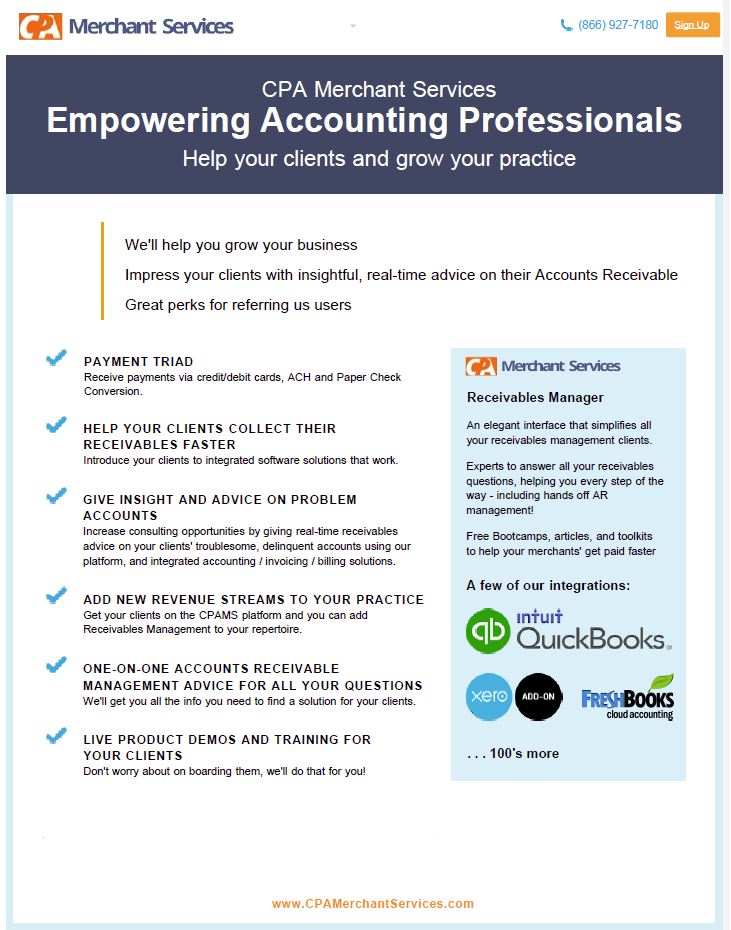

Leigh will provide information on proper completion of a Merchant Processing application. Be proactive with your clients - lower their payment processing costs! CPA Merchant Services has developed integrated payment processing for some of the top accounting programs, including QuickBooks, Xero & FreshBooks. Integrated solutions allow business owners the freedom to do what they do best! See how using "integrated" payment processing greatly reduces your clients Indirect costs of payment processing.

Leigh will take the time during and after the webinar to answer all your Payment Processing Questions.

Learning Objectives

- Manage ways to save your clients $$ and your time EVERY MONTH by completing the Merchant Application accurately

- Organize Tips and Tricks for easier merchant bank reconciliations

- Relate how to read merchant bank statements and how to force the processing bank to provide you easier-to-understand statements

- Explore "The true Direct costs" of payment processing

- Discover how to integrate payment processing with your favorite Accounting / Invoice software

Professional course material will be transmitted prior to the webinar for your records.

Find out more about the Virtual Conference format

Register now for Intermediate Credit Card Processing... only $19

3) Advanced Credit Card Processing...

"Emerging Payment Technologies - what you don't know will cost you, and your clients"

Field of Study: Economics: Money and Banking

Program Level: Advanced

Pre-requisite: Basic Credit Card Processing & Intermediate Credit Card Processing | Delivery Method: Group Internet Based

Advanced Preparation: None | Type of Credit: CPE for CPAs

Who Should Attend: This live webinar is designed for all CPAs, small business owners, tax, accounting and other professionals.

Recommended CPE: 1 "Credit" hour

Cost: $19 - All 3 Credit Card Processing webinars, only $60

Presenter: Leigh Cook - CPA Merchant Services

Thursday, August 11, 2016 ~ 1:00pm EST / 10:00am PST

Thursday, August 18, 2016 ~ 1:00pm EST / 10:00am PST

Thursday, August 25, 2016 ~ 1:00pm EST / 10:00am PST

View Details and Registration Info

Course Description

The payments landscape is constantly evolving and becoming more efficient. Are your merchants using "stale" or "outdated" processing methods? Leigh will provide guidance on keeping transaction processing secure and industry compliant in this digital age. Participants will explore Emerging Technologies. By the end of the year, there will be at least five major third-party wallets in the market backed by deep-pocketed tech companies and retailers: Apple Pay, Google Wallet, MCX-CurrentC, PayPal, and Samsung Pay. That's in addition to myriad private-label wallets like that of Starbucks.

Leigh will take the time during and after the webinar to answer all your Payment Processing Questions.

Learning Objectives

- Explore PCI compliance?

- Analyze how to become PCI compliant and how to maintain PCI compliance

- Discover how better inventory records will lower payment processing costs with Level III data

- Explore why an IPSP (Square, PayPal, etc.) works and why are these processors so expensive yet easy to install?

- Introduce how the Spread of Digital Payments Is Driving Online Links for Remote Devices

Professional course material will be transmitted prior to the webinar for your records

Find out more about the Virtual Conference format

Register now for Advanced Credit Card Processing... only $19

Register now for all three Credit Card Processing webinars and save!

|

Leigh Cook, CEO

(619) 450-5800 Leigh@CPAMerchantServices.com

Leigh is a very dynamic speaker who breaks down and teaches complex subjects with any "easy-to-follow" approach. She made learning Geometry, Trigonometry and Calculus fun and easy for thousands of high school students for 10 years. Leigh has spent the last 10 years in the payment industry as a leading sales agent and business owner.

She is currently the President of CPAMerchantServices.com a registered MSP/ISO of Elavon, Inc. With a strong knowledge of both payment processing and small business she is a mentor for many business owners. Her passion is seeing the 100 fold benefits of integrating systems within businesses in the area of payment processing. She currently works with businesses to navigate the confusing and overwhelming waters of the payment card industry. Whether the customer is processing $1 million a month or just $1,000, there is an integrated solution that can be in place to help the business owner succeed.

Empowering Accounting Professionals

Today Payments, Inc. dba: CPAMerchantServices.com is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors and will be approved by the date of the webinar. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.learningmarket.org

(more info )

|